Bandwagon effect & the ideology of lean

This is the 9th newsletter of Book Lovers sent on October 4, 2015, focusing on game theory, especially on bandwagon effect, and its effect in the adoption of new technologies.

This edition features Avinash K. Dixit and Barry J. Nalebuff.

Don't miss the following letters:

Rear-View Mirror

Last week, I've written a plea for relativism (and long content), in which I’ve highlighted two considerations:

1. as Spinoza wrote in Ethics, we don't desire things because we judge them to be good; on the contrary, we judge something to be good BECAUSE we desire it.

2. we should always remind ourselves that between all and nothing, there is something. Often we are engaged in battles that lure us into thinking that their can be only two camps… when in reality there are many more.

This Week

This week, this newsletter has been inspired by the greatest book I know about game theory: Thinking Strategically by Avinash K. Dixit and Barry J. Nalebuff. Whereas many books on game theory are filled by mathematics, this one is free of formulas and gives us nonetheless a very rigorous introduction to game theory. We understand very easily its key principles (brinkmanship, bargaining, unconditional moves, vicious circles), with a great diversity of illustrations, drawn from the military world, public policies, sport, political campaigns, etc. A must read, I swear. ;)

The Bandwagon effect

I’ll focus this newsletter on something called “bandwagon effect”, that points out the necessity of thinking strategically even in a world of increased complexity. The bandwagon effect is characterized by the probability of individual adoption increasing with respect to the proportion who have already done so. As more people come to believe in something, others also "hop on the bandwagon" regardless of the underlying evidence.

In this extract, the authors show that history matters in determining today’s technology choices. What could appear trivial is in fact very problematic: historical trade-offs may be irrelevant considerations in the present.

As they say “the important insight from game theory is to recognize early on the potential for future lock-in — once one option has enough of a head start, perior technological alternatives may never get the chance to develop. Thus there is a potentially great payoff in the early stages from spending more time figuring out not only what technology meets today's constraints, but also what options will be the best for the future.”

The ideology of lean

That doesn’t seem very much in coherence with the way we develop innovative product, right?

Under today’s ideology, we build prototype called “MVP” (minimum viable product) that we test and improve with quick iterations and small feedback loops. We never fire out if today's constraints will be the best for the future (and that is not a question of technical debt, I see you in the back raw!).

Discover two stories, from the book Thinking Strategically, that show how our society has been shaped by things like “hoof-and-mouth disease” and the “submarine space constraints”:

Gasoline as the best power source

"In 1890 there were three ways to power automobiles stearn, gasoline, and electricity — and of these one was patently the other two: gasoline. ... [A turning point for gasoline was] an 1895 horseless carriage competition sponsored by the Chicago Times Herald. This was won by a gasoline-powered Duryea - one of only two cars to finish out of six starters — and has been cited as the possible inspiration for R. E. Olds to patent in 1896 a gasoline power source, which he subsequently mass-produced in the "Curved-Dash Olds." Gasoline thus overcame its slow start. Steam continued viable as an automotive power source until 1914, when there was an outbreak of hoof-and-mouth disease in North America. This led to the withdrawal of horse troughs — which is where steam cars could fill with water. It took the Stanley brothers about three years to develop a condenser and boiler system that did not need to be filled every thirty or forty miles. But by then it was too late. The steam engine never recovered.

While there is little doubt that today's gasoline technology is better than steam, that's not the right comparaison. How good would steam have been if it had had the benefit of seventy five years of research and development? While we may never know some engineers believe that steam was the better bet."

Light-water reactors are suboptimal yet the norme

In the United States, almost all nuclear power is generated by light-water reactors. Yet there are reasons to believe that the alternative technologies of heavy-water or gas-cooled reactors would have been superior, especially given the same amount of learning and experience.

[Two main reasons for the curious minds:

(a) heavy-water reactors can operate without the need to reprocess fuel

(b) both heavy-water and gas-cooled reactors have a significantly lower risk of a meltdown]

The question of how light-water reactors came to dominate has recently been studied by Robin Cowen, in a 1987 Stanford University Ph.D. thesis.

The first consumer for nuclear power was the U.S. Navy.

In 1949, then Captain Rickover made the pragmatic choice in favor of light-water reactors. He had two good reasons. It was then the most compact technology, an important consideration for submarines, and it was the furthest advanced, suggesting that it would have the quickest route to implementation.

[...] At the same time civilian nuclear power became a high priority.

The Soviets had exploded their first nuclear bomb in 1949. In response, Atomic Energy Commissioner T. Murray warned, "Once we become fully conscious of the possibility that [energy-poor] nations will gravitate towards the USSR if it wins the nuclear power race, it will be quite clear that this race is no Everest-climbing, kudos-providing contest." [...]

Considerations of proven reliability and speed of implementation took precedence over finding the most cost-effective and safest technology. Although light-water was first chosen as an interim technology, this gave it enough of a head start down the learning curve that the other options have never had the chance to catch up.

Weekly #MustRead articles

This week, we will talk about three articles, two of which has been pointed out by people I like, so I'll pass them along with my thoughts on them.

1. Baptiste Bachellerie send me a piece that he loved (He told me “I like his concept of thin versus thick value (value that take externalities into account) that he describes in 'The New Capitalist Manifesto'.”).

As I really enjoyed the reading (but didn’t agree that much with the author), I share with you the article and the answer I sent him.

The article is titled The Unicorn Bubble (Or, Why You Shouldn’t Want to be the Next Uber), written Umair Haque, who tells us that we shouldn’t take Uber as a guide to innovate.

He raises very good questions (and highlight the necessity to take into account externalities) and assures that Uber has not such a great strategic position (low entry barriers, low switching costs, and low power). To be honest I was quite bittersweet at the end of the reading for the 3 following points:

1. In theory he's quite right about switching cost & barriers to entry but I feel they are harder and harder to take into consideration now in the digital world: we tend to underestimate (a) the cognitive cost of switching -- power of habits, (b) the barry that constitute users (both suppliers & demanders) which provides a tons of knowledge -- data + inside knowhow + brand.

Groupon is yet a really interesting counter-example: a strong brand that has been almost forgotten in the blink of an eye. Did they lack a sense of belonging from their user or some kind of magic in the use?

2. I'm quite cautious about the tactics of dominance: Uber is in a very specific position -- a massive legal "grey zone" at the very least. I don't like how they operate as a whole (they are quite agressive) but I don't think we can legitimately say they are weak because they have to fight to be authorized.

3. I really think - as many people do when they talk about innovation - that we shouldn't compare companies when they are giant success with new (or at least "young") entrants. Uber might have a terrific valuation but the firm is only 6 years old. Apple used to have lots of traits he highlights: a low bargaining power (and disputable practices), a barry that was really hard to cross in front them - Microsoft built tremendous network effects thanks to the interoperability of its softwares- and was really easy to switch from.

2. Nicolas Debock told me about his fondness for Carlo Rovelli, who could be, in his opinion, one of the greatest thinker of our time. I’ve looked for an introduction to his thinking and was not disappointed!

Rovelli tells us that we should “forget time” to understand the world. Contrary to what generally assumed, the physical world does not exist "in time". At the basic microscopic level, the world is better described in terms of a a-temporal theory, where physical laws do not express time evolution of physical variables, but just relations between variables. He explains that time is just a trick introduced in physics to help us study other variables, and this trick (using time as the “prime variable”) doesn’t work anymore when we try to combine general relativity, and quantum field theory.

For him, time only exists in our day-to-day life because of our ignorance of the microscopic state of the world: “if we knew every variables, there would be no time. [...] time is a side effect of ignorance.”

A great interview by Hélène Le meur in La recherche (french): Il faut oublier le temps

3. I've found an article myself! ;)

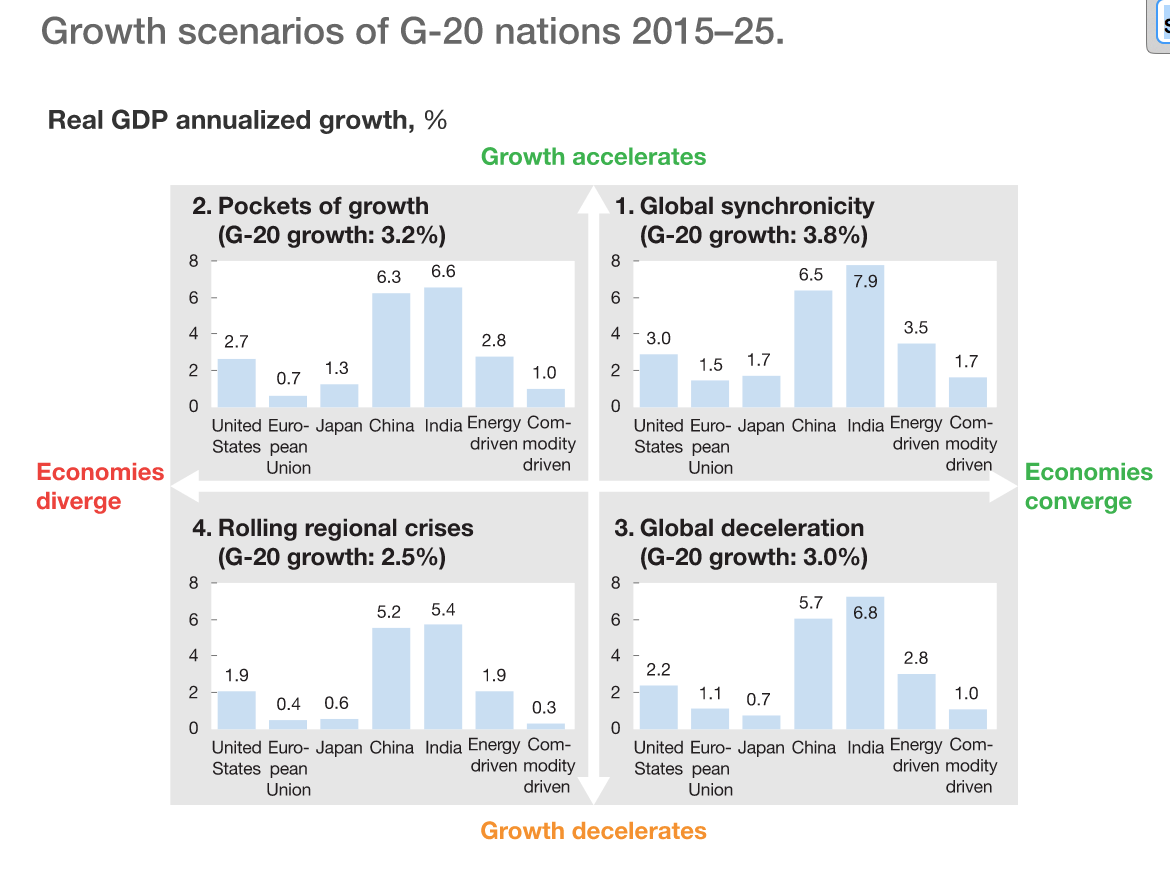

In Shifting tides: Global economic scenarios for 2015–25, 3 directors of McKinsey -- Luis Enriquez (McKinsey’s Brussels office), Sven Smit (Amsterdam office), and Jonathan Ablett (expert in the North American Knowledge Center in Waltham) wonder how will evolve the global economy in the next 10 years.

Will we witness a global convergence? Will it be linked with an acceleration of a deceleration of the economy?

They've articulated four global scenario, shaped by the 3 sets of factors outlined below:

near term forces: (a) monetary stimulus (most countries have a negative interest rate to encounter the weak demand) and (b) shifting energy markets (oil prices fell by 50 percent in the latter half of 2014, Even after a slight rebound, they remained well below average levels of the past five years)

long term forces:

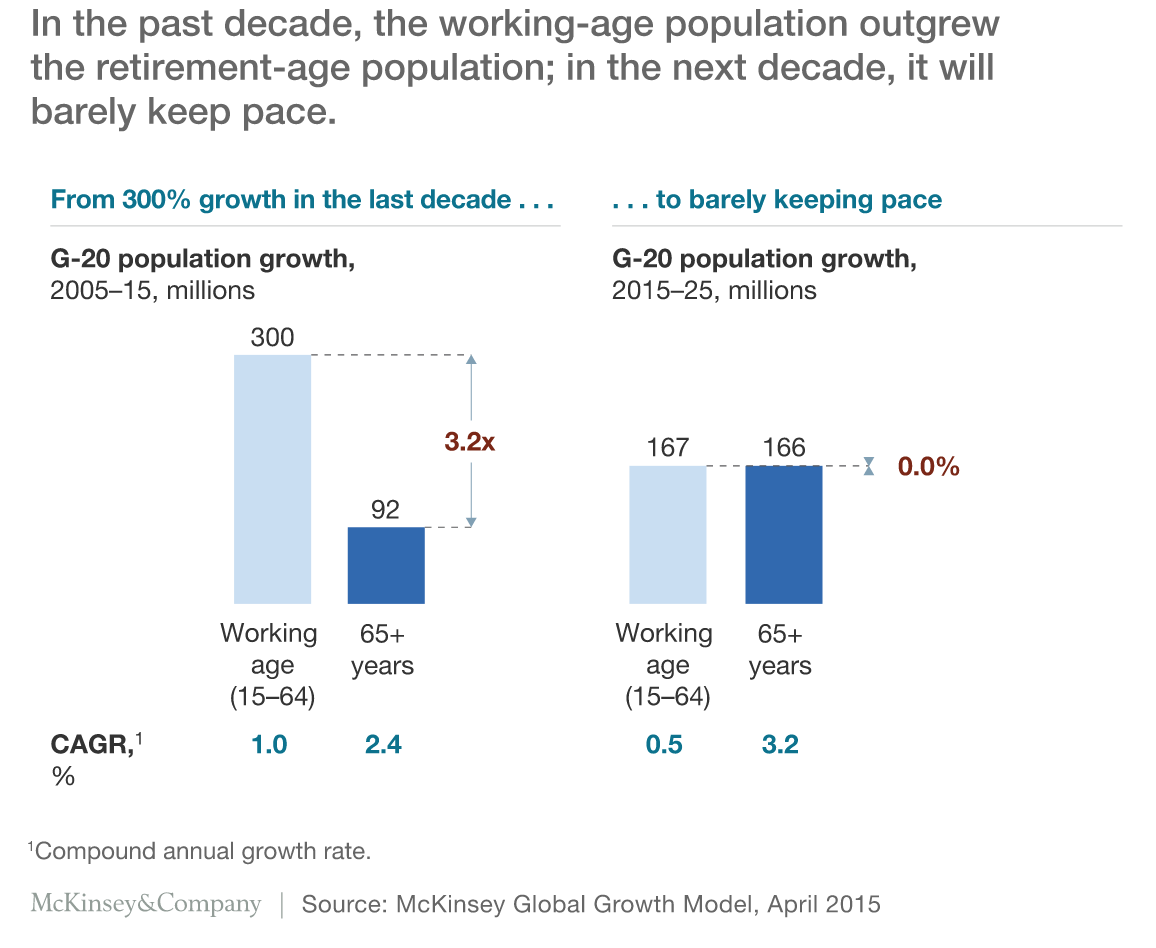

inexorable trends: (a) urbanization and (b) aging (life spans are growing and birthrates falling), which both impose burdens -among them, lower productivity, falling demand, and rising health and pension loads

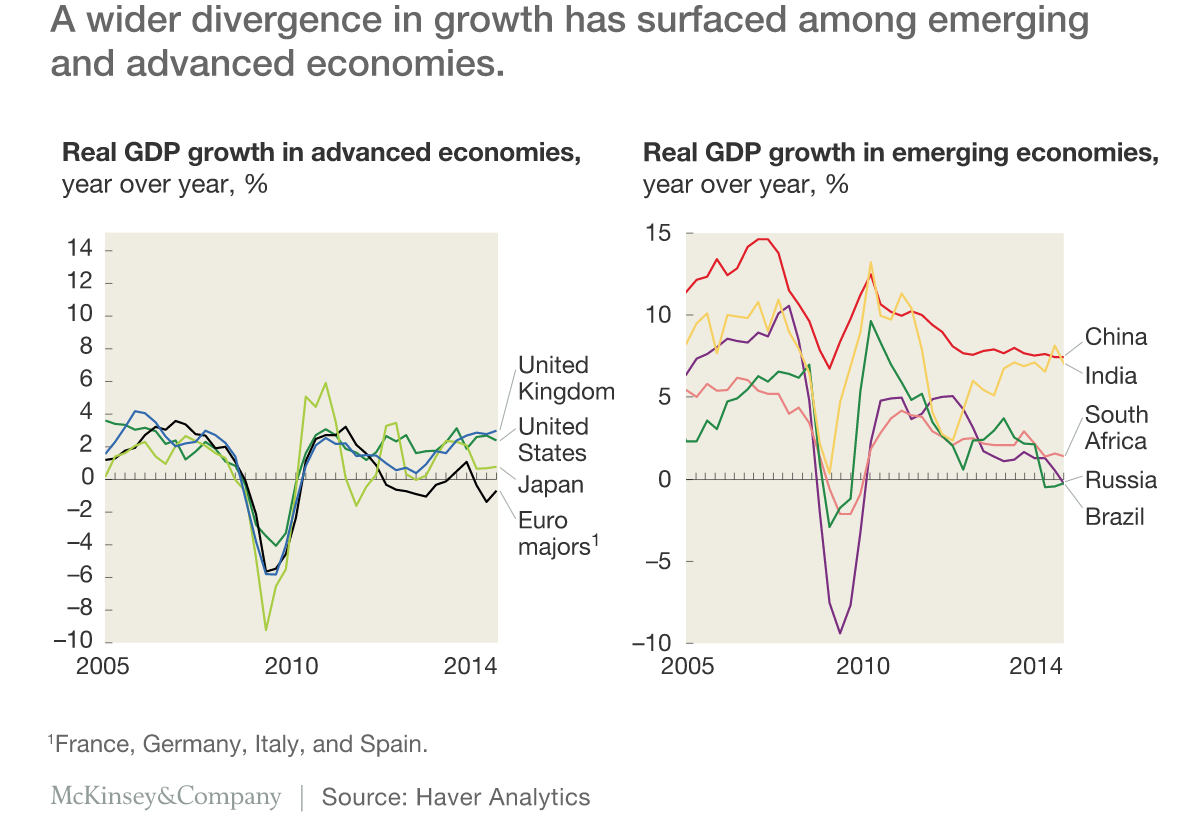

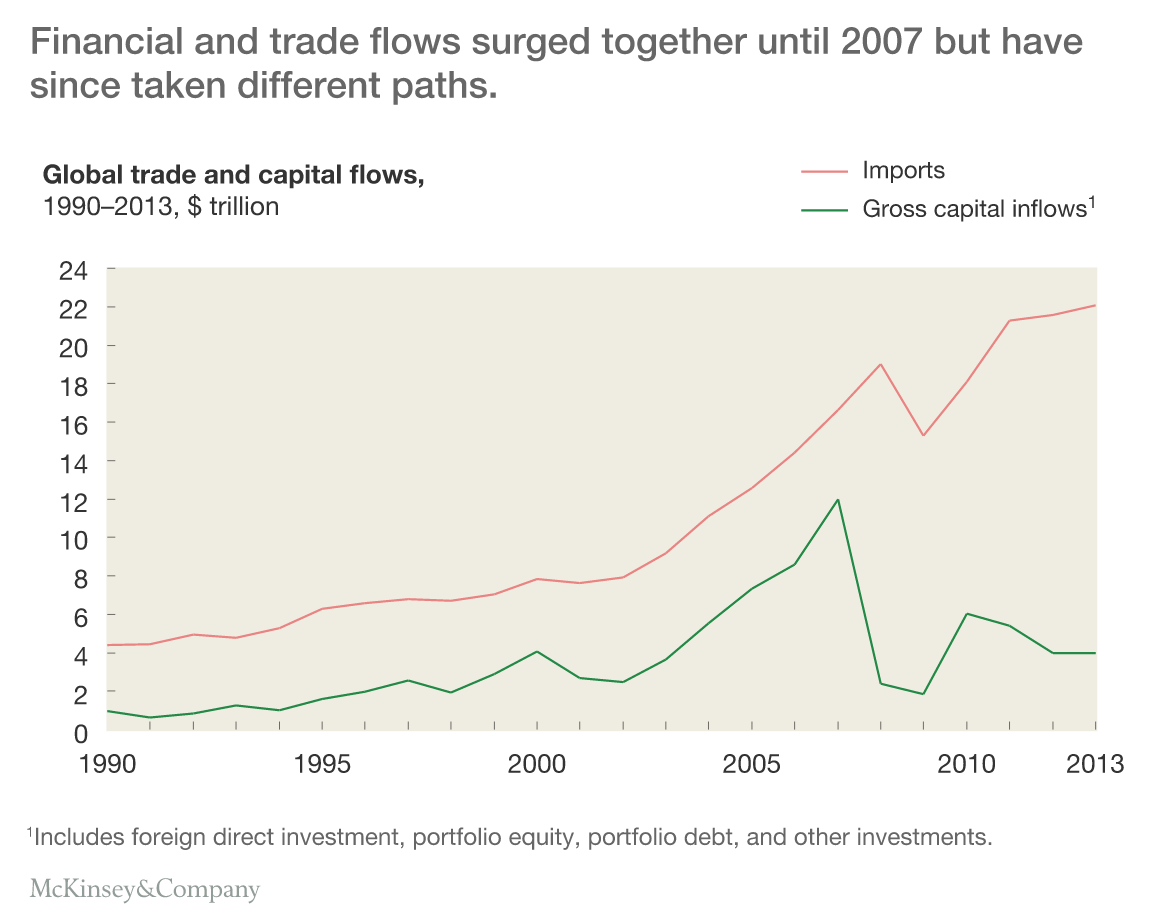

uncertain forces: (a) technological innovation and (b) global connectivity (trading relationships are increasingly dense and complex, with financial & economic flows seem to diverge since 2010)

If you enjoyed this week's newsletter, please forward it to someone you like.

And start the conversation by replying to this email or by sending my a quick tweet: @willybraun

Looking forward to having your feedbacks and your impressions after the readings.

Warm regards,

Willy